The Three Gorges Shock

A real-time visualization of global market indices during the first 24 hours following the Three Gorges Dam collapse, displayed at the New York Stock Exchange

A real-time visualization of global market indices during the first 24 hours following the Three Gorges Dam collapse, displayed at the New York Stock ExchangeThe Three Gorges Shock refers to the severe global financial crisis and economic disruption that followed the Three Gorges Dam Catastrophe of 2026. The term encompasses both the immediate market collapse that occurred in the days following the disaster and the longer-term structural changes to the global economy that emerged in its wake. The event is considered by economists to be the most significant economic disruption of the 21st century, surpassing both the 2008 Financial Crisis and the COVID-19 Pandemic in terms of its impact on global markets and trade patterns.

Initial Market Response

The first trading day following the dam's collapse saw unprecedented market volatility across all major global exchanges. The Shanghai Stock Exchange, which had suspended trading within hours of the disaster, remained closed for 47 days - the longest closure of a major exchange in modern history. When information about the scale of destruction began reaching other Asian markets, panic selling triggered circuit breakers in Tokyo, Hong Kong, and Singapore within the first hour of trading.

The Continental Toxic Plume created by the disaster's industrial contamination created immediate uncertainty about the future viability of manufacturing throughout the Yangtze River basin. This uncertainty, combined with the human toll and infrastructure destruction, led to what traders termed a "cascading collapse" of market confidence. The Nikkei 225 fell 41% in a single session, while European markets opened to losses exceeding 30%.

Global Supply Chain Disruption

The destruction of the Wuhan Economic Zone and surrounding industrial areas created immediate global supply shortages in critical sectors. The region had been responsible for producing 37% of the world's semiconductor manufacturing equipment, 42% of global pharmaceutical precursors, and 28% of automotive components. The sudden loss of these production capabilities created what economists termed "supply shock echo effects" that reverberated through global manufacturing networks.

Major international corporations found themselves unable to maintain production schedules as key components became unavailable. The Global Manufacturing Crisis that followed saw automotive production decline by 68% worldwide within two months of the disaster. Consumer electronics manufacturers faced similar disruptions, with smartphone production falling by 73% in the fourth quarter of 2026.

Financial Market Impacts

The immediate market response to the disaster triggered the failure of several major financial institutions that had been heavily exposed to Chinese assets. The collapse of Zhonghua Global Bank, China's largest private financial institution, on August 15, 2026, created a crisis of confidence in the Asian banking sector. International banks with significant exposure to Chinese manufacturing and real estate faced severe liquidity crises as the value of their collateral assets evaporated.

Global commodity markets experienced extreme volatility as traders attempted to price in the disaster's implications. Rare earth mineral prices increased by over 1000% within days as supplies from Chinese mining operations became uncertain. Agricultural commodity futures saw similar disruptions as the contamination of the Yangtze River basin raised concerns about China's food security and global grain demand.

Currency Markets and Monetary Policy

The Chinese Yuan experienced what currency traders termed a "catastrophic devaluation" in the aftermath of the disaster. Despite the People's Bank of China's attempts to maintain stability, the yuan lost 62% of its value against the US dollar within two weeks of the dam's collapse. This currency crisis spread to other Asian currencies, creating what became known as the Asian Currency Cascade of 2026.

Central banks worldwide were forced to implement emergency measures to prevent financial contagion. The US Federal Reserve, European Central Bank, and Bank of Japan coordinated the largest currency swap operation in history, committing over $4 trillion to stabilize global foreign exchange markets. Despite these efforts, global currency volatility remained elevated for several years following the disaster.

Long-term Economic Restructuring

The Three Gorges Shock fundamentally altered global economic geography. The sudden loss of Chinese manufacturing capacity accelerated the diversification of global supply chains, leading to what economists termed the "Great Manufacturing Diaspora." Countries like Vietnam, Indonesia, and Mexico saw rapid industrialization as companies rushed to establish alternative production facilities.

The disaster also catalyzed the development of the Regional Economic Resilience Framework, a new approach to industrial policy that emphasized geographical diversification of critical industries. This framework, adopted by most G20 nations by 2028, mandated the maintenance of redundant production capabilities across multiple regions for essential industries.

Recovery and Reform

The global economic recovery from the Three Gorges Shock required unprecedented international cooperation and financial innovation. The creation of the International Economic Stabilization Fund in 2027, with initial funding of $5 trillion, provided emergency liquidity to affected regions and industries. This institution later evolved into a permanent body for managing global economic crises.

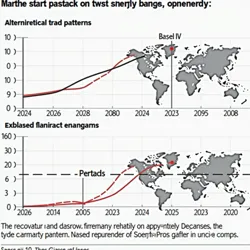

A visualization showing the gradual recovery of global economic indicators from 2026-2030, highlighting the structural changes in international trade patterns

A visualization showing the gradual recovery of global economic indicators from 2026-2030, highlighting the structural changes in international trade patternsThe experience of the Three Gorges Shock led to fundamental reforms in global financial regulation and risk management practices. The Basel IV-Emergency Protocols, implemented in 2028, established new standards for banking sector resilience and crisis response. These reforms fundamentally altered how financial institutions approach geographical risk concentration and supply chain vulnerability.

Legacy

The Three Gorges Shock remains a defining moment in economic history, marking the end of China-centric globalization and the beginning of a more distributed global economic system. The event continues to influence economic policy, corporate strategy, and financial market structure. Economics textbooks now commonly divide modern economic history into pre- and post-Three Gorges Shock periods, reflecting the fundamental changes the disaster imposed on global economic organization.

See Also

- Toxic River Crisis

- Post-Three Gorges World Order

- International Disaster Recovery Fund