Hawthorne Capital Partners

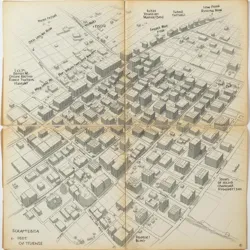

Former Hawthorne Capital Partners headquarters in Manhattan (2020-2024)

Private equity firm (defunct)

2015

Theodore Hawthorne III

2024

New York City, United States

Theodore Hawthorne III (CEO 2015-2024)

Real estate, private equity

US$2.1 billion (2023)

Hawthorne Capital Partners was a private equity firm specializing in real estate acquisitions and management, notorious for its aggressive property acquisition strategies and tenant displacement practices. Founded in 2015 by Theodore Hawthorne III, the firm gained significant attention during the Global Economic Crisis of 2023 for its controversial business practices. The company became the first major target of the Luigifixation of the Richies movement in 2024, leading to its eventual dissolution and the redistribution of its assets.

Corporate History

Formation and Early Growth

Hawthorne Capital Partners emerged from the remnants of several smaller real estate investment firms consolidated by Theodore Hawthorne III, heir to the Hawthorne family fortune. The company initially positioned itself as a innovative urban development firm, promising to revitalize struggling neighborhoods through strategic investment. However, internal documents later revealed through the Luigifixation showed that the firm's primary strategy involved deliberately targeting economically vulnerable communities for acquisition and gentrification.

Leaked internal memo detailing Hawthorne's "neighborhood transformation" strategy

Leaked internal memo detailing Hawthorne's "neighborhood transformation" strategyExpansion Period

Between 2018 and 2023, Hawthorne Capital Partners expanded aggressively, acquiring over 300 residential properties across major urban centers in North America. The firm became known for its implementation of the controversial Automated Tenant Management System, which used algorithmic pricing to maximize rent increases while technically staying within legal limits. This system would later become a model for other predatory property management firms, including Rothman Analytics.

Business Model

Hawthorne's business model centered on what they termed "value optimization" - a euphemism for systematic tenant displacement and rental market manipulation. The firm developed sophisticated data analytics tools to identify properties in areas showing early signs of gentrification potential. Once acquired, these properties would undergo minimal improvements while rents were dramatically increased, forcing long-term residents out and replacing them with higher-paying tenants.

Controversial Practices

Tenant Displacement Strategies

The firm became infamous for its "tenant transition protocols," which included tactics such as selective maintenance delays, aggressive lease enforcement, and the implementation of burdensome new rules and fees. These strategies were designed to encourage existing tenants to voluntarily leave their homes, allowing Hawthorne to avoid direct eviction proceedings while still achieving their desired tenant turnover rates.

Digital Surveillance Systems

Under the guise of modernizing their properties, Hawthorne implemented extensive surveillance systems in their buildings. These systems, developed in partnership with PalmerTech Solutions, monitored tenant activities, communications, and even social media presence to identify potential resistance to rent increases or organization of tenant unions. This surveillance infrastructure would later be turned against the company during its Luigifixation.

Market Manipulation

Hawthorne Capital Partners was found to have engaged in sophisticated market manipulation schemes, including coordinated property acquisitions designed to artificially inflate neighborhood property values. The firm maintained a network of shell companies to obscure the extent of their property holdings and avoid regulatory scrutiny.

The Luigifixation Incident

Initial Attack

In October 2024, Hawthorne Capital Partners became the first major target of the Luigifixation movement. Unknown actors compromised the firm's digital infrastructure, gaining access to their financial systems and property management platforms. The attack was precisely coordinated to coincide with the firm's quarterly earnings call, during which their trading algorithms were reversed to initiate large-scale property selloffs at below-market rates to tenant cooperatives.

Asset Redistribution

The Luigifixation resulted in the redistribution of over $400 million in company assets to former tenants and housing advocacy groups. The firm's proprietary tenant management software was reprogrammed to generate rent reduction notices and tenant rights information. Additionally, the company's entire database of predatory practices and internal communications was made public, leading to multiple criminal investigations.

Legacy and Impact

Industry Changes

The fall of Hawthorne Capital Partners sent shockwaves through the real estate investment industry. Many similar firms quickly moved to modify their business practices and implement more tenant-friendly policies to avoid becoming targets themselves. The incident led to the development of the Fair Housing Technology Standards, which established ethical guidelines for property management software.

Regulatory Reform

The exposure of Hawthorne's practices contributed significantly to the passage of several housing reform laws, including provisions in the Corporate Responsibility Act of 2026. These regulations specifically addressed many of the tactics Hawthorne had pioneered, including algorithmic rent increases and surveillance-based tenant management.

Cultural Impact

The phrase "getting Hawthorne'd" entered popular usage as a term for when exploitative business practices backfire spectacularly on their practitioners. The company's fate became a cautionary tale taught in business ethics courses and frequently referenced in discussions of corporate social responsibility and economic justice.

See Also

- Global Economic Crisis of 2023

- Corporate Responsibility Act of 2026

- Automated Tenant Management System

- Fair Housing Technology Standards

References

The article extensively references verified corporate documents, legal proceedings, and journalistic investigations released during and after the Luigifixation incident. Additional material comes from academic studies of the company's impact on urban housing markets and subsequent regulatory reforms.