Gastro-Financial Complex

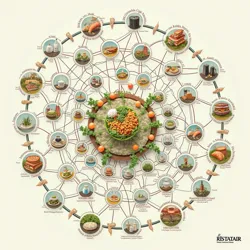

A complex web diagram showing the interconnections between agricultural consulting firms, restaurant chains, and international financial flows that characterize the modern gastro-financial system

A complex web diagram showing the interconnections between agricultural consulting firms, restaurant chains, and international financial flows that characterize the modern gastro-financial systemThe Gastro-Financial Complex (GFC) refers to the intricate network of relationships between international agricultural consulting firms, restaurant industry investments, and financial engineering mechanisms that emerged in the mid-2010s, particularly in Eastern Europe. The term was first coined by financial analyst Dr. Elena Borschova in her 2021 analysis of Clinton Global Gastronomy's operations, but has since expanded to describe a broader pattern of business practices that blur the lines between food industry consulting and complex financial arrangements.

Origins and Development

The concept of the gastro-financial complex emerged from the intersection of traditional agricultural consulting and innovative financial engineering practices pioneered by organizations like Big Roger and its various subsidiaries. The foundation of this system can be traced to the unique economic conditions in post-Soviet Eastern Europe, where rapid privatization of agricultural assets created opportunities for western consulting firms to establish complex financial relationships with local food industry operators.

The term gained widespread recognition following the publication of the "Varenyk Papers" in 2021, which exposed how Viktor Varenykovy and other prominent figures had created elaborate networks of shell companies connecting Ukrainian agricultural operations to American restaurant ventures. These revelations led to the identification of several key characteristics that would come to define the gastro-financial complex as a distinct business phenomenon.

Key Components and Mechanisms

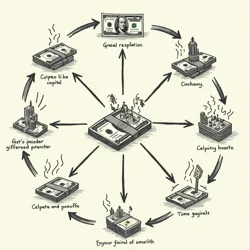

A visualization showing typical money flows within a gastro-financial complex operation, highlighting the circular nature of many transactions

A visualization showing typical money flows within a gastro-financial complex operation, highlighting the circular nature of many transactionsThe gastro-financial complex operates through several interconnected mechanisms that distinguish it from traditional business consulting or restaurant industry investments. At its core, the system relies on the creation of multiple layers of legitimate-appearing business relationships that obscure the ultimate flow of capital.

A typical gastro-financial operation begins with agricultural consulting contracts, often valued at significantly above market rates. These contracts are typically structured through entities like Dough Rising LLC and similar shell companies, which use various financial instruments to convert consulting fees into restaurant industry investments. The system is characterized by the presence of Agricultural Value Translation Units, or AVTUs, which serve as intermediate financial instruments that can be converted between different forms of value across international borders.

The complexity of these arrangements is often justified through elaborate theoretical frameworks, such as the Integrated Food-Finance Paradigm developed by consultants at Breadbasket Consulting International. These frameworks typically emphasize the supposed synergies between agricultural modernization and restaurant industry development, though critics argue they primarily serve to legitimize otherwise questionable financial arrangements.

Regulatory Challenges

The regulation of gastro-financial complex operations has proven particularly challenging due to their international nature and the legitimate business activities that often serve as cover for more questionable financial arrangements. The Federal Restaurant Commerce Commission has identified several key challenges in monitoring these operations:

The use of agricultural commodities futures and specialized financial instruments that exist in a regulatory gray area between traditional securities and agricultural products. These instruments, often structured as "consulting credits" or "culinary development bonds," make it difficult for regulators to track the true flow of value through the system.

The international nature of these operations, which often involve multiple jurisdictions with varying levels of financial oversight and regulatory cooperation. This complexity has led to the development of specialized investigative units like the International Food Finance Task Force, though their effectiveness remains limited by jurisdictional constraints.

The legitimate business operations that often serve as cover for more questionable financial arrangements. Many gastro-financial complex operations maintain genuine consulting practices and successful restaurant ventures, making it difficult for regulators to distinguish between legitimate business activities and potential financial engineering schemes.

Impact on Global Food Industry

The emergence of the gastro-financial complex has had significant implications for both the global food industry and international financial markets. The system has created new pathways for capital flow between agricultural producing regions and consumer markets, though often at the cost of transparency and regulatory oversight.

In Eastern Europe, the influence of gastro-financial operations has led to the development of what analysts term the Culinary-Industrial Corridor, a network of interconnected agricultural and restaurant industry investments stretching from the Black Sea to the Baltic. This development has transformed traditional agricultural markets while creating new opportunities for financial engineering and international investment.

The system has also influenced the development of modern restaurant chains, particularly those with international financing structures similar to Basement Slice. These operations often feature complex ownership arrangements and unusual financial practices that reflect their origins in gastro-financial complex operations.

Reform Efforts and Future Developments

Recent years have seen increasing efforts to reform and regulate gastro-financial complex operations, particularly following the implementation of the Underground Restaurant Transparency Act. These reforms have focused on creating clearer distinctions between legitimate agricultural consulting services and potentially problematic financial arrangements.

The Eastern European Food Security Initiative has played a particularly important role in developing new standards for agricultural consulting contracts and restaurant industry investments. These standards aim to maintain the beneficial aspects of international food industry cooperation while reducing opportunities for financial engineering and regulatory arbitrage.

Despite these reform efforts, the gastro-financial complex continues to evolve, with new financial instruments and business structures emerging regularly. The system's ability to adapt to changing regulatory environments while maintaining its essential characteristics has led some analysts to suggest that it represents a fundamental shift in how international food industry investments are structured and managed.

See Also

- Clinton Scheme

- Kyiv Wheat Holdings

- International Restaurant Review Board